Volunteer Income Tax Assistance Program (VITA)

Contents (click to jump to a section)

Contents (click to jump to a section)

United Way of Central Texas goes the extra mile to help the community.

Appointments for the 2025 tax season will be available after January 26, 2026.

During the Tax Season, (February – April) the VITA program offers free tax help to people who generally make $69,000 or less, persons with disabilities, the elderly, and limited English speaking taxpayers who need assistance in preparing their own tax returns. Our IRS certified VITA volunteers provide basic income tax return services without charge, ensuring 100% of the tax refund goes directly to the customer.

When tax season arrives, volunteers with UWCT’s Volunteer Income Tax Assistance (VITA) program dedicate themselves to preparing hundreds of tax returns for Central Texas residents in need. With the help of many community partners, these IRS-certified volunteers return over a million dollars to our community and save our co-workers, neighbors, and friends hundreds of thousands of dollars in tax preparation fees.

In addition to VITA, the Tax Counseling for the Elderly (TCE) program offers free tax help for all taxpayers, particularly those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

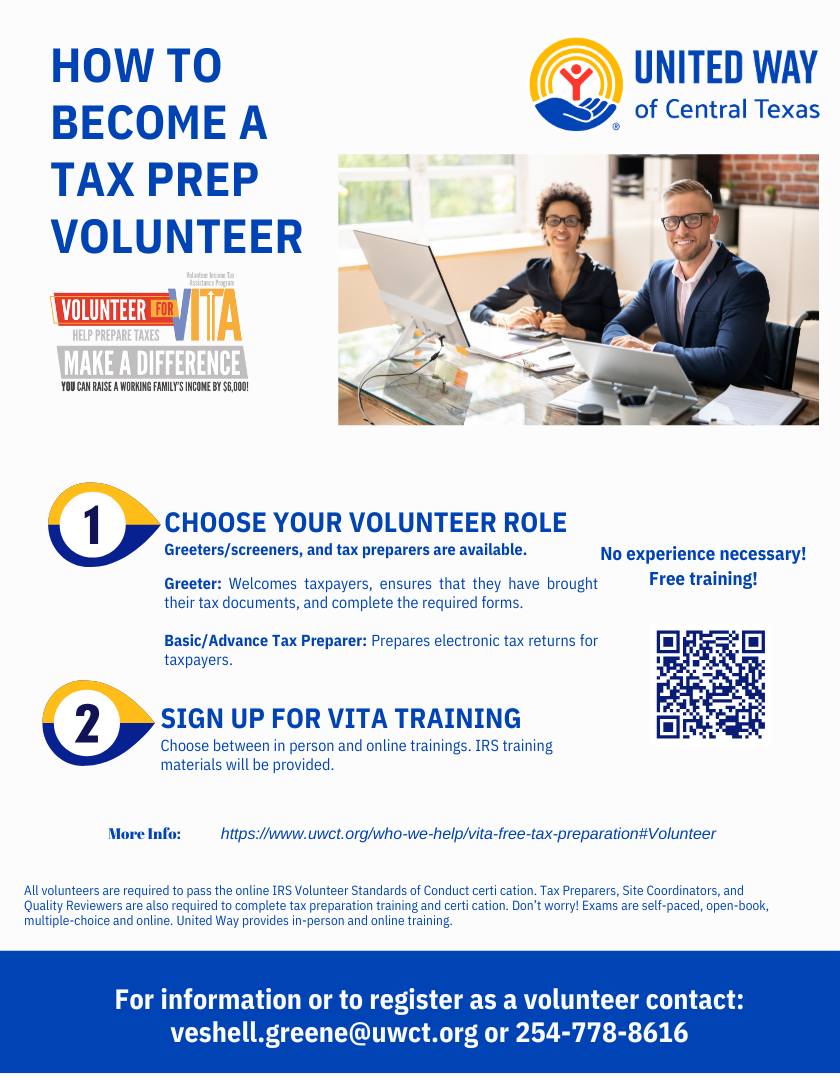

Becoming a VITA Volunteer

United Way of Central Texas volunteers prepare tax returns free of charge for low-income families all across Central Texas. A 16-hour training course is provided for anyone interested in learning to be a Tax Preparer at the beginning, intermediate and advanced levels. Volunteers are also needed to serve as Greeters at the tax site. No formal training or skills are needed to be a greeter. We also need Interpreters onsite to help translate to non-English speaking clients.

United Way of Central Texas volunteers prepare tax returns free of charge for low-income families all across Central Texas. A 16-hour training course is provided for anyone interested in learning to be a Tax Preparer at the beginning, intermediate and advanced levels. Volunteers are also needed to serve as Greeters at the tax site. No formal training or skills are needed to be a greeter. We also need Interpreters onsite to help translate to non-English speaking clients.

- Register to be a VITA volunteer HERE.

VITA Training Resources – Free for Volunteers

Get ready for tax season with free VITA training materials provided by the IRS. These include:

-

Publication 6744: VITA/TCE Volunteer Test/Retest

-

Publication 4012: Volunteer Resource Guide

- Publication 5379: Link & Learn Q&A

- Ready to test? Click HERE

These resources are great for new and returning volunteers who want to strengthen their tax preparation skills.

For more information call/email our office: 254-778-8616 or info@uwct.org

****APPOINTMENTS****

To Qualify: Household income of $69,000 a year or less.

- Click here for your appointment request: HERE

***If no appointments are available, please check back at a later time.***

- We have VITA sites in Temple, Belton, Killeen, and Harker Heights. View all of our locations HERE.

Must be one of the following filing statuses: Single, Married Jointly, Head of Household, or Qualifying Widow(er)

Must bring the following documents:

- Photo ID

- Social Security card and/or ITIN card

- For you, your spouse, and all dependents

- All tax documents that need to be filed for current or past years

If applicable:

- Copy of last year’s Federal Tax return

- For year 2025

- 1099-G

- Unemployment insurance benefits

- 1099-INT

- Bank interest

- 1098-T

- Gambling winnings

- 1098-E

- Interest on a student loan

- Notice 1319

- Advance child credit

- 1099-MISC

- 1095-(A, B, or C)

- Proof of health insurance

- Void check/savings account (optional)

- Statement with bank routing numbers (optional)

- If you are married filling jointly, your spouse needs to be present at the appointment

File for an Extension

The deadline to file an extension of time to file your 2025 individual tax return is April 15th, 2026.

For more information on how to file an extension, please visit www.IRS.gov or click HERE.

IRS Free File

Free File is where you can prepare and file your federal individual income tax return for free using tax preparation-and-filing software.

Click HERE for more info, or visit www.IRS.gov

MyFreeTaxes

MyFreeTaxes is a free, national, online tax filing product. It is mobile optimized so anyone can access MyFreeTaxes from their computer, tablet, or smart phone.

MyFreeTaxes is completely free for households who earned less than $73,000 in 2025 - whether you file in multiple states, work freelance or a side gig, or earn investment income. And if you have questions, IRS-certified specialists are ready to answer questions in real time.

Click MyFreeTaxes.com to get started!

Did you make more than the VITA income limit of $69,000 or the MyFreeTaxes income limit of $73,000? Filing for free may still be available to you by visiting MyFreeTaxes and walking through the step-by-step instructions to transfer to Cash App Taxes (formerly Credit Karma Tax).

Frequently Asked Questions

Do I need an appointment?

Yes, appointments are required. No show appointments will not be rescheduled. If for some reason you are not ble to make it to your appointment, please call at least 24 hours in advance and reschedule.

Do I qualify for free tax preparation through VITA?

If you made $69,000 or less you may qualify. Upon calling for an appointment additional information will be eeded to determine if you qualify.

If you were self-employed, for us to do your taxes:

• Business expenses (including mileage) must be less than $35,000.

• Bring in an itemized list of ALL business expenses along with business mileage log to your appointment—this needs to be completed prior to the appointment (we do standard mileage rate not actual car expenses and we cannot do business use of home expenses or any depreciation)

• You cannot have employees working for you

• Bring in a total of ALL income earned for your business, whether you got a 1099-NEC or not, all income including cash must be reported.

(If you had a business loss, had employees, or your expenses exceeded $35,000 then you are not eligible for our services and should contact a paid professional)

Do you own any rental property?

(If yes, you are not eligible and should contact a paid professional)

Do you have Farm income?

(If yes, you are not eligible for our service and should contact a paid preparer).

Do you have investment income?

• The program volunteers have limited training and cannot prepare returns with complicated capital gains. Excessive stock trading will not qualify. (Ex. Scottrade, Ameritrade, E-trade accounts, buying and selling stock with a personal account frequently. Please see a professional preparer for assistance.)

(If you had crypto currency, you are not eligible for our services and should contact a paid professional)

What should I bring to my tax appointment?

• A copy of most recent prior year’s federal tax returns if available

• Valid Photo ID for all adults

• Social Security Cards or ITINs for you, your spouse and dependents or a Social Security Number verification letter.

• Birth dates for you, your spouse and all dependents

• If you are married and filing jointly, your spouse must be present with you.

• Wage and earning statement(s) Form W-2, W-2G, 1099-R, 1099-NECs from all employers

• Form 1095-A Health insurance marketplace information **A MUST if you have Marketplace Insurance

• Your IP Pin- Identity Protection Pin If you are enrolled in the IRS PIN program.

• Interest and dividend statements from banks, brokers, and student loan companies—Form 1099-INT,1099-DIV,1098-E or other forms received that indicate on the form that it is for tax purposes.

• If you or a dependent was in college or trade school working for a degree last tax year, bring the 1098-T from the university/school to see if you may qualify for an education credit. (Bring totals spent on books and required school supplies, if applicable)

• Savings or Checking account routing numbers and account numbers for Direct Deposit, such as a blank check **Consider splitting your refund into two (2) accounts to save for an emergency• ;Total paid to daycare provider for each dependent, the business name, Employer Identification

•Number or Social Security Number, and address

• If self-employed: Complete proof of all income and expenses (see notes above)

Do I need to file?

•Yes, if you have low earned income, you may be eligible for the Earned Income Tax Credit (EITC). EITC is a free tax credit for certain people who work and have low wages.

• Yes, if you had income tax withheld from your wages, social security/retirement/pension income, or made quarterly estimated payments

• Yes, if you had Marketplace Health Insurance , make sure to bring your 1095A from Marketplace.

What are Tax Credits? Some people benefit from tax credits. Here are some examples of tax credits that can really make a difference on your return: Earned Income Tax Credit (EITC) Child Tax Credits Credits for Other Dependents American Opportunity Tax Credit Lifetime Learning Credit Child and Dependent Care Credit Retirement Savings Tax Credit How fast will I get my refund? **With the IRS falling so far behind last tax season due to COVID and all the tax law changes, it is hard to predict what will happen this year. Some clients got their refund in under two weeks, but the many taxpayers had to wait 2-5 months. The IRS tells us to expect the IRS to issue your refund in less than 21 calendar days after your tax return has been received. And direct deposit is quick, easy, secure and the best way to receive your refund. But please don’t spend your refund until it is received--don’t rely on it being in your account by a certain date, it may take longer.

Get up to date refund information at: Where's My Refund? *Per Congress...Refunds containing the Earned Income Tax Credit (EITC) and/or the Additional Child Tax Credit (ACTC) can’t be released by the IRS before Feb. 15 (and sometimes later)

Should I wait to file if I know I will owe money? No, you can file now and pay as late as April 15th. To avoid late filing fees, you should file even if you are going to be unable to pay your taxes. *The penalty for not filing on time can be 25% of your balance due added to your bill, plus interest—so make sure to file on time—even if you can’t pay!

Is help available with prior year or amended tax returns? Yes, just make sure to schedule an appointment and let us know what you need. You will need to schedule an appointment for each tax year you need prepared.

Who will complete the return?

Our VITA volunteers are IRS certified. Each site has an on-location site coordinator who performs a quality review check for accuracy prior to a return being filed.

How many years back can I have my taxes done/amended?

Our program is able to complete taxes up to 3 (three) years of prior tax returns.

I claimed the EITC (Earned Income Tax Credit) and/or the Additional Child Tax Credit on my tax return. When can I expect my refund?

According to the Protecting Americans from Tax Hikes (PATH) Act, the IRS is required to hold EITC and Child Tax Credit refunds until mid-February. The IRS expects the earliest EITC/Child Tax Credit related refunds to be available in taxpayer bank accounts or debit cards starting the end of February, if they chose direct deposit and there are no other issues with the tax return. Learn more HERE or visit www.IRS.gov

Can I receive my refund by direct deposit?

Yes. If you are eligible for a refund, you can arrange to have your refund deposited directly into your account. Bring a voided check or the routing number and account number.

Can I receive my refund by mail instead of direct deposit?

Yes. If you are eligible for a refund, your volunteer will ask you for your current mailing address.