News Release

Contact: Mary Beth Kauk | marybeth.kauk@uwct.org

(254) 778-8616

FOR IMMEDIATE RELEASE: 01/25/17

United Way of Central Texas' Annual VITA Program Helps Access the Earned Income Tax Credit, an Anti-Poverty Program, to Help Advance the Common Good

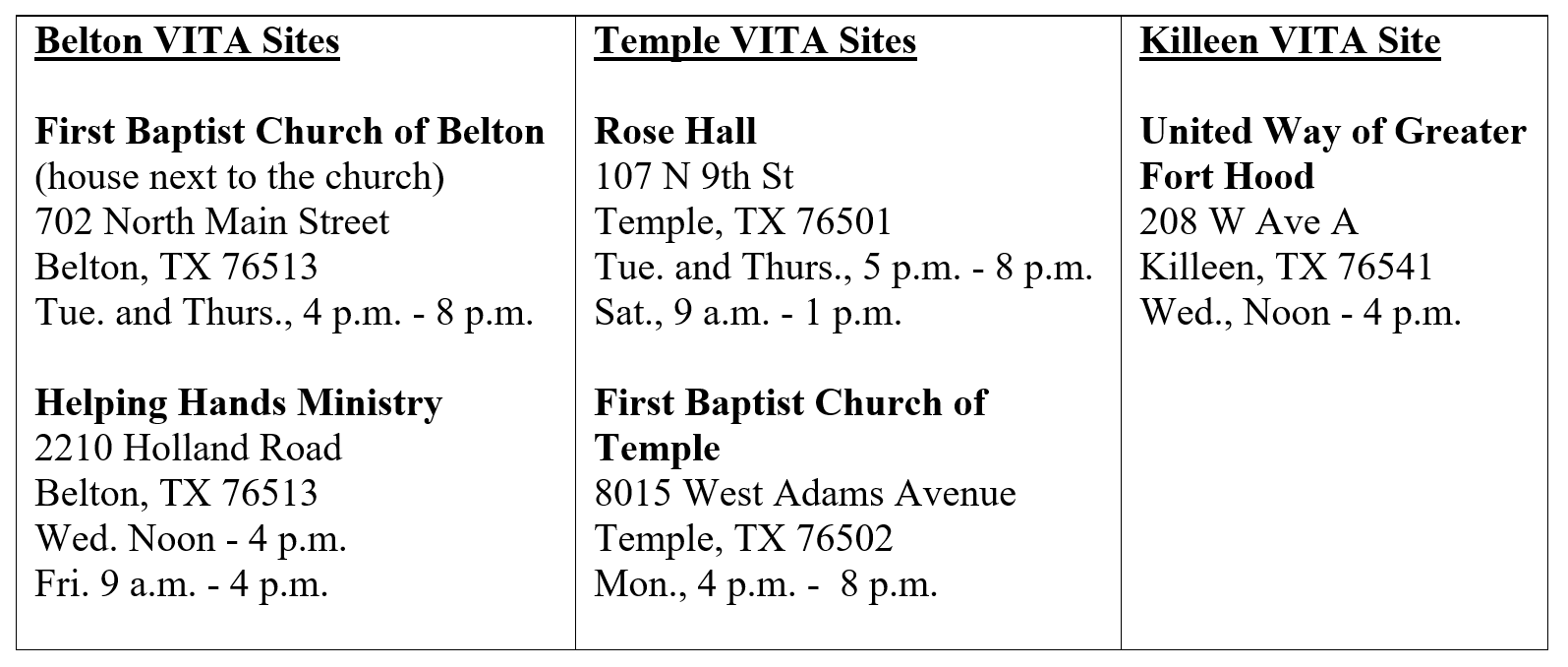

Temple, Texas – January 25, 2017 – United Way of Central Texas (UWCT) and its community partners—Helping Hands Ministry of Belton, the McLane School of Business at the University of Mary Hardin-Baylor, Central Texas Workforce Solutions, Temple College, and Fort Hood United Way— will kick-off the 2017 Volunteer Income Tax Assistance (VITA) program in February. Temple, Belton, and Killeen VITA sites will open the week of February 6, 2017. To schedule an appointment, please call the United Way of Central Texas office at 254-778-8616.

In 2016, the UWCT VITA volunteers prepared 839 free tax returns for Central Texans and brought in over $1 Million in refunds and $409,689 in Earned Income Tax Credits (EITC) to our local community. VITA volunteers are IRS certified and knowledgeable in EITC providing basic income tax return services without charge, ensuring 100% of the tax refund goes directly to the customer.

National Earned Income Tax Credit Awareness Day is January 27. The Earned Income Tax Credit (EITC) and is a broadly considered our nation’s most effective pro-work, anti-poverty tool. The EITC is a refundable federal tax credit for lower income working people that encourages and rewards work, offsetting the federal payroll and income taxes, and giving low to moderate-income working families a stronger possibility of financial stability, advancing the common good and creating opportunities for all.

Research suggests that EITC positively affects children and families far beyond the limited timeframe during which families claim the credit. In fact, studies show that the EITC improves child health and academic achievement, increasing the likelihood of college attendance and improving prospects for higher earnings when children become adults. Only those who work are eligible, allowing them to keep more of what they earn.

In 2013, the EITC helped to lift more than 9,000,000 Americans out of poverty while also generating significant economic activity in local communities.

When tax season arrives, VITA volunteers dedicate themselves to preparing hundreds of tax returns for Central Texas residents. Helping a family complete a tax return offers instant gratification as a volunteer. A single mother of two who makes $18,000 can be eligible for a child tax credit and the Earned Income Tax Credit. In this example, considering both of those tax credits, she would receive a tax return of about $5,000.

This is UWCT’s ninth year to provide tax assistance to the local community. Clients eligible to have their taxes prepared for free must make less than $50,000 a year—last year, the average client income was $22,000 per year.

UWCT is engaging Central Texans and bringing people together to solve community problems. Long-term economic success is not possible without an investment in long-term human success. Working together, we are building strong neighborhoods — all over Central Texas— where individuals and communities can thrive.

For more information about the United Way of Central Texas, please visit www.UWCT.org.

UWCT VITA sites will open the week of February 6, 2017. To schedule an appointment, please call the United Way of Central Texas office at 254-778-8616.